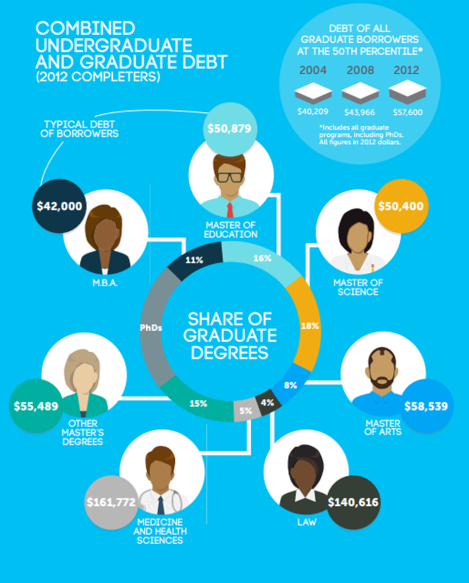

I finished college and like many of my friends walking with me at the graduation ceremony, I had a stream of Sallie Mae courtesy letters in the mail reminding me that debt is real and the people who want to collect money are very real. The average loan debt for students earning a bachelor’s degree was $29,400 in 2012, and if you go on to earn a Master’s in Arts like my friends and I, the debt rises to $58,589 on average. I made it out with about $11,000 in debt for my entire education, but only because I qualified for Pell Grants during my undergrad, the programs I wanted were in-state, and luckily, I haven’t had any big financial burdens from health or family responsibilities.

via Jason Delisle’s “The Graduate Student Debt Review“

The above infographic doesn’t even take into consideration how many of us have other debt that we used to pay for simple things like food and housing or the occasional night out. This other debt often takes the form of credit cards, but some of my friends are also debt to their family. The Pell Grant is a big friend for low income students in their undergraduate years, but there is no Pell Grant at the graduate level and must resort to borrowing, or working a job at the same time, which is not ideal for anyone.

Along with the Pell Grant, I had worked as a clerk at a grocery store for a year, and then I did work-study as an peer academic adviser that paid a meager $8.00/hr and while I worked about 20hrs/week. The meager wage got me some awesome experience and letters of recommendation that got me into grad school, so I stuck with it. I also earned scholarships from The Lightfoot Foundation, and Idaho Labor. My mother also paid for my books until I earned the Idaho Labor scholarship, and my Grandpa chipped in about $1,000.

There’s more. I had savings that I earned from working between the ages of 16-19. I worked 20 hours a week during high school, and 30-40 during summer. A large chunk of that disappeared when I decided to live in the dorms my first year at college without working, but I knew the first year was critical to learning the ropes at the university.

Grad students can score some type of institutional work, like teaching or research assistantship, but these rarely cover the cost of living and college. Many of my fellow grad students at the time held a second job. My teaching assistanship stipend was on level with the poverty line, plus paid tuition. I taught 3 courses each year, and even had my health insurance paid for. I was fortunate to earn this, extremely fortunate, but many don’t get a good deal like this, especially in programs that don’t need grad instructors or researchers.

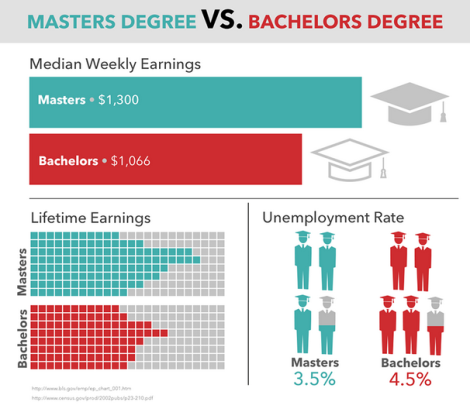

Still, if we’re speaking in pure finances, it seems to pay off to go on to a Master’s program compared to staying with a Bachelor’s on average, but of course, not all masters are created equal so take with a grain of salt.

My advice to students paying for college:

- Seek out financial opportunities within colleges and departments and apply for everything.

- In-state is way cheaper, but there are also out-of-state waivers. Ask the respective college, academic department, or Financial Aid department.

- Avoid accruing interest on loans or credit cards. Not all loans and cards are equal in how they expect repayment. A subsidized loan does not accrue interest while you are attending college, but an subsidized loan does.

- Take credits at cheaper colleges or universities and then transfer, OR, do dual credit between colleges. For example, some students at Boise State University will also take generic classes at College of Western Idaho for a lower cost.

- Thrift stores and Craigslist are your friends. Avoid purchasing things your can’t re-sell

- Find a job where you can do homework. It might sound obvious, but a work-study can be great when you’re sitting at a desk doing nothing while having time to write an essay or do some reading. Working 30 hours at a work-study position, even for low pay, can keep you afloat financially AND academically.

If you have any of your own advice, questions, or stories, feel free to add them to the comment section below!